The Ultimate Guide: Credit Card Processing Fees Explained Simply for Your Business

Credit card processing fees explained: Navigating the world of commerce as a business owner means juggling countless responsibilities, from inventory and marketing to customer service and growth. Amidst this complexity, one of the most persistent and often confusing expenses is payment processing. You accept a credit card, the payment goes through, and at the end of the month, a statement arrives riddled with percentages, per-transaction costs, and various line-item charges.

For many, deciphering these costs feels like an impossible task. This guide is here to change that. We are providing a comprehensive breakdown where all aspects of credit card processing fees explained in detail, empowering you to understand exactly where your money is going and how you can keep more of it.

Understanding this financial ecosystem is not just an accounting exercise; it’s a critical business strategy. The fees you pay directly impact your profit margins on every single card transaction. Without a clear grasp of the components, you could be overpaying by hundreds or even thousands of dollars each year. This in-depth guide is designed for beginners and seasoned business owners alike, offering a clear and comprehensive resource.

We will demystify the jargon, break down complex pricing structures, and provide actionable advice to help you make more informed decisions. By the end of this article, you will have a complete picture of credit card processing fees explained, turning a point of confusion into an area of confident financial management for your business.

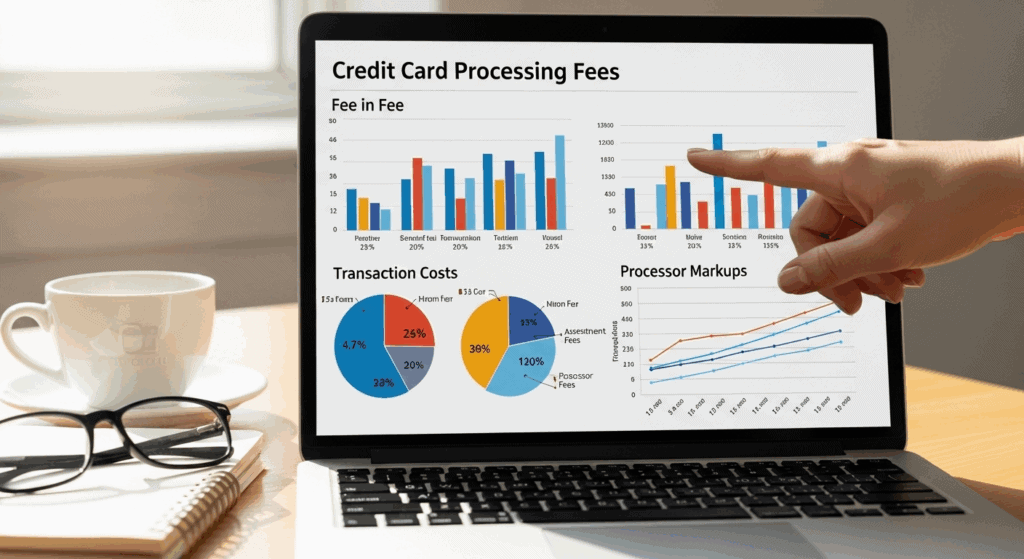

The Three Core Components: A Foundational Look at Credit Card Processing Fees Explained

At its heart, every single credit card transaction fee you pay is a combination of three distinct components. While your monthly statement might lump them together or present them in a confusing way, understanding these individual parts is the first and most crucial step. Having these core credit card processing fees explained is the key to unlocking the rest of the puzzle.

Interchange Fees: The Unavoidable Bulk of the Cost

The largest portion of your processing fees—typically accounting for 70-90% of the total cost—is the interchange fee. This is a non-negotiable fee that the merchant’s bank credit card processing fees explained (the acquiring bank) pays to the customer’s bank (the issuing bank) for each transaction.

- Who Sets Them? Interchange rates are set by the major card networks themselves, namely Visa, Mastercard, Discover, and American Express. They publish vast and complex tables with hundreds of different rate categories, which are typically updated twice a year (in April and October).

- What Influences Them? The specific interchange rate applied to a transaction is determined by a multitude of risk-related factors, including:

- Card Type: A standard debit card has a much lower interchange rate than a premium rewards or corporate credit card because debit transactions are funded by existing cash and are considered lower risk.

- Transaction Method: A “card-present” transaction where a customer dips a chip card or uses a contactless payment method is more secure and thus has a lower rate than a “card-not-present” transaction, such as an online payment or a manually keyed-in number, which carries a higher risk of fraud.

- Merchant Category Code (MCC): Your business type, identified by a four-digit MCC, also plays a role. Supermarkets and charities, for example, often receive lower interchange rates than other retail businesses.

Think of the interchange fee as the cost of doing business in the credit card world. It’s the price paid for the convenience, fraud protection, and payment guarantees that the issuing bank provides. No matter which payment processor you choose, this underlying cost remains the same. The goal is to partner with a processor who passes this cost to you transparently. The bedrock of having credit card processing fees explained is knowing what interchange is and how it works.

Assessment Fees (or Card Brand Fees): The Card Networks’ Cut

The second component is the assessment fee. This is a smaller, non-negotiable fee that goes directly to the card networks (Visa, Mastercard, etc.) for the use of their payment rails, brand, and network infrastructure. It’s their charge for maintaining the system that makes global card payments possible.

- How Are They Calculated? Assessment fees are typically calculated as a small percentage of the total transaction volume for each card brand. For example, as of recent data, Visa’s assessment fee might be around 0.14%, while Mastercard’s could be about 0.1375%.

- Are There Other Network Fees? Yes. In addition to the primary assessment fee, card networks may charge other small, fixed fees per transaction. For instance, Visa has a Fixed Acquirer Network Fee (FANF) that is charged on a tiered basis depending on your business size and processing volume.

These fees are much smaller than interchange fees but are equally non-negotiable. A transparent processor will pass these fees directly to you without any markup. When you seek to have credit card processing fees explained properly, ensuring you understand these pass-through costs is vital.

Processor Markup: The Provider’s Profit and Service Charge

The third and final component is the processor’s markup. This is the only part of the fee that is negotiable and is how your chosen payment processing company makes its money. The markup covers the cost of their services, technology, customer support, risk management, and, of course, their profit margin.

The structure of this markup is what differentiates one payment processor from another and is defined by the pricing model you choose. Some processors bake their markup into confusing tiers, while others add a simple, transparent percentage and/or per-transaction fee on top of the wholesale interchange and assessment costs. Understanding this markup is the most critical element when comparing providers, as it’s the only variable you can control. For any business owner wanting credit card processing fees explained, mastering the concept of the processor markup is where you can find significant savings.

A Deep Dive into Pricing Models: How Your Fees Are Structured

Now that you understand the three core components, let’s explore how payment processors package them into different pricing models. The model you’re on dictates the transparency and predictability of your monthly costs. Choosing the right one for your business is essential. The variety of models can be confusing, but by having these credit card processing fees explained, you can select the one that best fits your business needs.

Tiered Pricing: The Simple but Often Costly Model

Tiered pricing is one of the most common models offered, especially to new or small businesses, because it seems simple on the surface. The processor bundles the hundreds of interchange rates into three (or more) “tiers.”

- Qualified: The lowest rate, typically reserved for standard debit cards and non-rewards credit cards that are swiped or dipped in person.

- Mid-Qualified: A higher rate for transactions that don’t meet the “Qualified” criteria, such as loyalty and rewards cards, or cards that are keyed-in manually.

- Non-Qualified: The highest rate, applied to premium rewards cards, corporate cards, and most card-not-present transactions (like e-commerce).

The problem with tiered pricing is the lack of transparency. The processor decides which transactions fall into which tier, and they often route the majority of transactions to the more expensive Mid- and Non-Qualified tiers. This inflates their profit margin, as the difference between the actual interchange cost and the tier rate is pocketed by them. While it looks simple, it’s rarely the most cost-effective option, and it fails to have your credit card processing fees explained in an honest way.

Interchange-Plus (or Cost-Plus) Pricing: The Transparent Choice

Interchange-Plus is widely regarded by industry experts as the most transparent and fair pricing model available. It works by separating the core components.

- How It Works: The processor passes the true, non-negotiable interchange and assessment fees (the “cost”) directly to you. They then add their fixed, pre-negotiated markup (the “plus”) on top.

- Example: Your markup might be 0.20% + $0.10 per transaction. So, on a transaction with a 1.50% interchange fee, your total rate would be 1.70% (1.50% + 0.20%) + $0.10.

The beauty of this model is its complete transparency. You know exactly what the wholesale cost is and exactly how much your processor is making on every single transaction. This allows for clear, apples-to-apples comparisons between providers and ensures you benefit when you accept lower-cost cards. For businesses that truly want their credit card processing fees explained without any smoke and mirrors, Interchange-Plus is the gold standard.

Flat-Rate Pricing: Predictability at a Price

Made popular by companies like Square and PayPal, flat-rate pricing offers ultimate simplicity and predictability. You pay one single, flat percentage rate (e.g., 2.6%) and a fixed per-transaction fee (e.g., $0.10) for all in-person transactions, and a different flat rate (e.g., 2.9% + $0.30) for online transactions and credit card processing fees explained, regardless of the card type.

- Pros: It’s incredibly easy to understand and forecast your expenses. There are no complex statements to decipher. This is particularly appealing to micro-businesses, startups, or businesses with very low monthly processing volumes.

- Cons: Simplicity comes at a cost. The single flat rate is set high enough to cover the processor’s costs for even the most expensive premium rewards cards. This means that when you accept a low-cost debit card, you are significantly overpaying. The processor pockets the large difference between the low interchange cost and their high flat rate. Businesses with moderate to high volume will almost always save more money on an Interchange-Plus model. This model offers the simplest version of credit card processing fees explained, but often at the highest effective cost.

Subscription / Membership Pricing: A Modern Approach

A newer model in the industry, subscription pricing (also called membership pricing) aims to eliminate the percentage-based markup altogether.

- How It Works: You pay a fixed monthly subscription fee to the processor. In return, they pass the wholesale interchange and assessment fees directly to you with only a small, fixed per-transaction fee (e.g., $0.05 – $0.15) and no percentage markup.

- Best For: This model is highly advantageous for businesses with high monthly processing volumes and a high average ticket size. The fixed monthly fee is easily offset by the savings from not paying a percentage-based markup on every sale. It’s the ultimate in transparency, but the monthly fee may be prohibitive for very small or seasonal businesses.

Table: Comparison of Credit Card Processing Pricing Models

To provide a clearer picture, here is a detailed table that breaks down the four primary pricing models. This visual representation helps to have the different approaches to credit card processing fees explained side-by-side.

| Feature | Tiered Pricing | Interchange-Plus (Cost-Plus) | Flat-Rate Pricing | Subscription / Membership |

| How it Works | Processor groups hundreds of interchange rates into 2-4 “tiers” (e.g., Qualified, Non-Qualified). | Processor passes through the true wholesale interchange & assessment costs, then adds a fixed markup. | A single percentage and per-transaction fee is charged for all cards of a certain type (e.g., in-person vs. online). | A fixed monthly subscription fee is charged in exchange for direct access to wholesale rates plus a small, fixed per-transaction fee. |

| Pros | Appears simple on initial quotes. Easy to explain at a surface level. | Full transparency. Most cost-effective model for most businesses. Allows for direct comparison of processors. | Extremely simple and predictable. Easy to forecast costs. Good for very low-volume or new businesses. | Highly cost-effective for high-volume businesses. No percentage markup from the processor. Extremely transparent. |

| Cons | Lacks transparency. Processor controls tier routing, often inflating costs. Difficult to compare quotes accurately. | Statements can appear more complex initially due to the level of detail. | Can be very expensive for businesses as they grow. You overpay on low-cost debit card transactions. | The monthly subscription fee can be high, making it unsuitable for small or seasonal businesses. |

| Best For | Rarely the best option. Often marketed to businesses unfamiliar with processing fees. | Most established small to large businesses seeking fairness, transparency, and long-term savings. | Micro-businesses, pop-up shops, freelancers, and businesses with very low or unpredictable sales volume. | High-volume businesses with a large average ticket size (e.g., auto repair, B2B, professional services). |

The Transaction Journey: How a Fee is Born from Swipe to Settlement

To fully appreciate the fee structure, it helps to understand the lightning-fast journey a transaction takes behind the scenes. This process, which takes only a few seconds, involves multiple parties, each playing a role and justifying their portion of the fee. Having this lifecycle of credit card processing fees explained provides context for why the system is structured the way it is.

Step 1: Authorization

When a customer presents their card (swipes, dips, taps, or enters it online), the payment terminal or gateway securely sends the transaction details to your payment processor. The processor then routes this request through the appropriate card network (Visa, Mastercard, etc.) credit card processing fees explained to the customer’s issuing bank. The issuing bank checks for available funds or credit, employs fraud detection tools, and either approves or denies the transaction, sending the response back along the same path. This is the “authorization” step.

Step 2: Batching

Throughout the business day, all your approved authorizations are stored in a “batch” by your payment processor. At the end of the day, you “close the batch,” which sends the complete file of all your daily transactions for settlement. This is a crucial step; failing to batch out daily can sometimes lead to higher interchange rates for those transactions.

Step 3: Clearing and Settlement

Once the batch is submitted, the clearing and settlement process begins. Your processor sends the batch file to the card networks. The networks then facilitate the movement of funds, debiting the appropriate issuing banks for the transaction amounts (minus their interchange fees) and crediting your acquiring bank. Finally, your acquiring bank deposits the total funds from the batch into your business bank account, minus all the combined fees (interchange, assessments, and the processor’s markup). This entire fund transfer process typically takes 1-3 business days. Every step in this process contributes to the overall cost, and this is a core part of having credit card processing fees explained.

Factors That Directly Influence Your Processing Rates

Beyond the pricing model, several other factors can significantly impact the rates you pay. Understanding these variables is key to managing and potentially lowering your costs. A complete overview of credit card processing fees explained must include these critical influencing factors.

Card Type: Debit vs. Credit, Rewards vs. Non-Rewards

As mentioned, the type of card used is the single biggest determinant of the interchange rate.

- Debit Cards: Have the lowest rates because the funds are drawn directly from a bank account, representing secured funds and minimal risk.

- Standard Credit Cards: Carry a higher rate than debit cards.

- Rewards Cards (Cash Back, Airline Miles): These have even higher interchange rates. The issuing banks use the higher fees collected from merchants to fund the rewards programs they offer to their cardholders.

- Corporate & Purchasing Cards: These often have the highest rates due to the increased data requirements, higher risk, and valuable rewards/perks associated with them.

Transaction Method: Card-Present vs. Card-Not-Present

How you accept the card is a major factor in determining the risk and, therefore, the rate.

- Card-Present (CP): Swiping, dipping an EMV chip, or using a contactless method (like Apple Pay) is the most secure method and receives the lowest rates. The physical presence of the card and security features like the chip dramatically reduce the risk of fraud.

- Card-Not-Present (CNP): This category includes e-commerce transactions, payments taken over the phone, and manually keyed-in cards. These are inherently riskier as the physical card isn’t present, leading to significantly higher interchange rates to cover the increased potential for chargebacks and fraud. A thorough examination of credit card processing fees explained always highlights this crucial distinction.

Your Industry and Merchant Category Code (MCC)

Every business that accepts credit cards is assigned a four-digit Merchant Category Code (MCC) that identifies its primary line of business. Card networks use MCCs to categorize and track spending, but they also use them to assign risk levels and interchange rates and credit card processing fees explained . For example, a restaurant (MCC 5812) will have different interchange qualification rules than a supermarket (MCC 5411) or an e-commerce store (MCC 5964). Certain categories, like charities and utilities, are often granted lower rates.

Your Average Transaction Size and Monthly Volume

Your sales patterns also play a role.

- Average Transaction Size (Average Ticket): Businesses with very small average tickets (e.g., a coffee shop) might benefit from a pricing structure with a lower per-transaction fee, even if the percentage rate is slightly higher. Conversely, a business with a high average ticket (e.g., a furniture store) should prioritize the lowest possible percentage rate.

- Monthly Processing Volume: As your sales volume increases, you gain more negotiating power with your processor. High-volume businesses can often secure a much lower markup on an Interchange-Plus plan, making it crucial to reassess your rates as your business grows. This dynamic aspect is fundamental to having long-term credit card processing fees explained.

Practical Strategies to Lower Your Credit Card Processing Fees

Armed with this knowledge, you are now in a position to take active steps to reduce your costs. Lowering your processing fees is an ongoing process, not a one-time fix. Having your credit card processing fees explained is the first step; taking action is the next.

Negotiate with Your Processor

The processor’s markup is negotiable. If you are on an Interchange-Plus plan, you can directly negotiate for a lower markup (e.g., asking to reduce your rate from 0.30% + $0.15 to 0.20% + $0.10). If you are on a tiered plan, your best negotiation tactic is to demand to be switched to an Interchange-Plus plan. Shop around and get quotes from other providers; a competing offer is your best leverage.

Encourage Lower-Cost Payment Methods

While you can’t refuse a certain type of card, you can incentivize customers to use lower-cost methods.

- Surcharging/Cash Discounting: In most jurisdictions, it is legal to add a small surcharge (up to 4%) to credit card transactions to cover the fees, or to credit card processing fees explained offer a discount for customers who pay with cash or debit. Be sure to follow all card brand rules and local laws regarding signage and disclosure if you choose this route.

- Promote ACH/E-check Payments: For B2B businesses or recurring billing, encouraging clients to pay via ACH (Automated Clearing House) transfers can lead to massive savings, as ACH fees are typically very low and not percentage-based.

Ensure PCI Compliance to Avoid Fines

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to protect cardholder data. All credit card processing fees explained businesses that accept credit cards must be PCI compliant. If you fail to validate your compliance or fall out of compliance, your processor will charge you a hefty monthly “PCI Non-Compliance Fee.” This is an easily avoidable penalty.

Process Transactions in Batches Daily

As mentioned in the transaction journey, failing to settle your batch at the end of each day can cause your transactions to be “downgraded” by the card networks. This means they will be processed at a higher interchange rate. Make it a part of your daily closing procedure to batch out your terminal or gateway to ensure you receive the best possible rates for your transactions. This simple operational habit is a key part of having credit card processing fees explained from a practical standpoint.

Understand and Minimize Chargebacks

A chargeback occurs when a customer disputes a charge with their bank. Not only do you lose the sale amount, but you are also hit with a chargeback fee from your processor, which can range from $15 to $50 or more. A high chargeback ratio can also lead your processor to increase your rates or even terminate your account. Minimize chargebacks by providing excellent customer service, having a clear return policy, and using fraud prevention tools, especially for online sales.

Conclusion: Turning Confusion into Confidence

The world of payment processing is intentionally complex, but it doesn’t have to be a black box. By breaking it down into its core components—interchange, assessments, and markup—and understanding how different pricing models package these costs, you can strip away the confusion and see your fees for what they are. The journey to having credit card processing fees explained is a journey toward empowerment.

Your goal as a business owner should be to align yourself with a transparent pricing model like Interchange-Plus and partner with a processor who acts as a true consultant, not just a vendor. Scrutinize your monthly statements, ask questions, and don’t be afraid to negotiate or switch providers to get the best deal. Every fraction of a percent you save on processing fees is a direct addition to your bottom line, fueling your business’s growth and success. With this guide, you now have the knowledge to transform one of your most opaque expenses into a manageable and optimized part of your financial strategy.

Frequently Asked Questions (FAQ)

1. What is a typical total percentage for credit card processing fees?

There is no single “typical” fee, as it depends heavily on your industry, transaction methods, and the types of cards you accept. However, a business’s “effective rate” (total fees divided by total processing volume) often falls between 2% and 3.5%. For card-not-present businesses, this can be higher. The best way to understand your specific costs is to get a detailed statement analysis based on a transparent pricing model like Interchange-Plus, where you can see the non-negotiable wholesale costs separate from the processor’s markup.

2. Is it possible to completely avoid paying credit card processing fees?

For the merchant, it’s not possible to avoid the fees entirely if you want to accept credit cards. The interchange and assessment fees are non-negotiable costs required to participate in the card networks’ systems. However, you can credit card processing fees explained offset these costs through strategies like surcharging (adding a fee for credit card use) or cash discount programs, where legally permitted. These programs effectively pass the processing cost on to the customer who chooses to pay with a credit card.

3. What is the difference between a payment processor and a merchant account?

A payment processor (or acquirer) is the company that provides the technology and service to handle credit card transactions. A merchant account is a specific type of business bank account that allows a business to accept and process credit card payments. Your payment processor facilitates the setup of your merchant account with an acquiring bank, and funds from your settled transactions are deposited into this account before being transferred to your primary business bank account.

4. Are credit card processing fees tax-deductible?

Yes, absolutely. Credit card processing fees are considered a necessary cost of doing business. You can—and should—deduct the full amount of the fees you pay as a business expense on your tax returns. This is an important part of financial management where having your credit card processing fees explained by an accountant can also be beneficial.

5. How often do the underlying interchange rates change?

The major card networks, Visa and Mastercard, typically update their interchange rate tables twice per year, in April and October. These changes can be increases, decreases, or the introduction of new transaction categories. credit card processing fees explained A transparent processor on an Interchange-Plus plan will simply pass these adjustments through to you. Processors on tiered or flat-rate models may use these biannual updates as an opportunity to raise their own rates disproportionately.